Steve M. Windham, LLM, MBA, EA

Founder & Owner

Email: steve@windhamsolutions.com

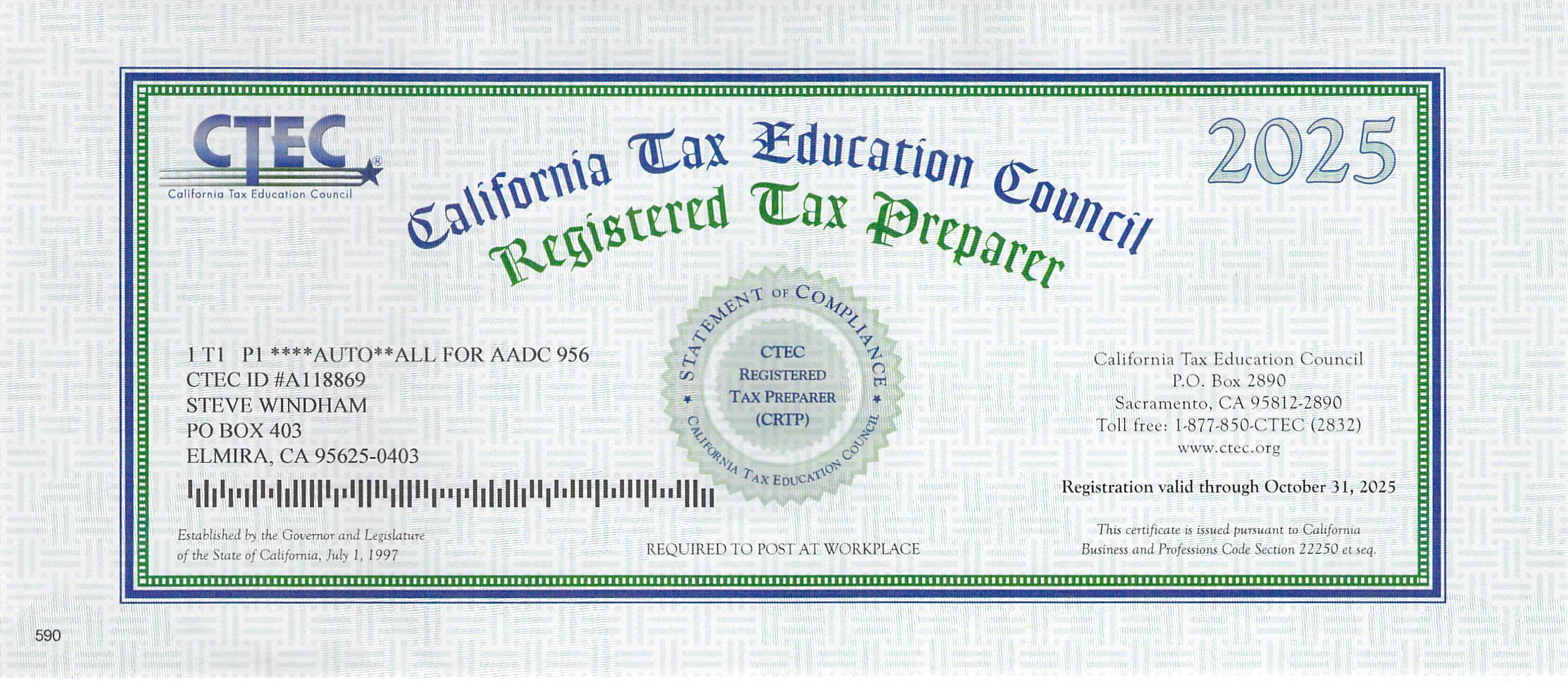

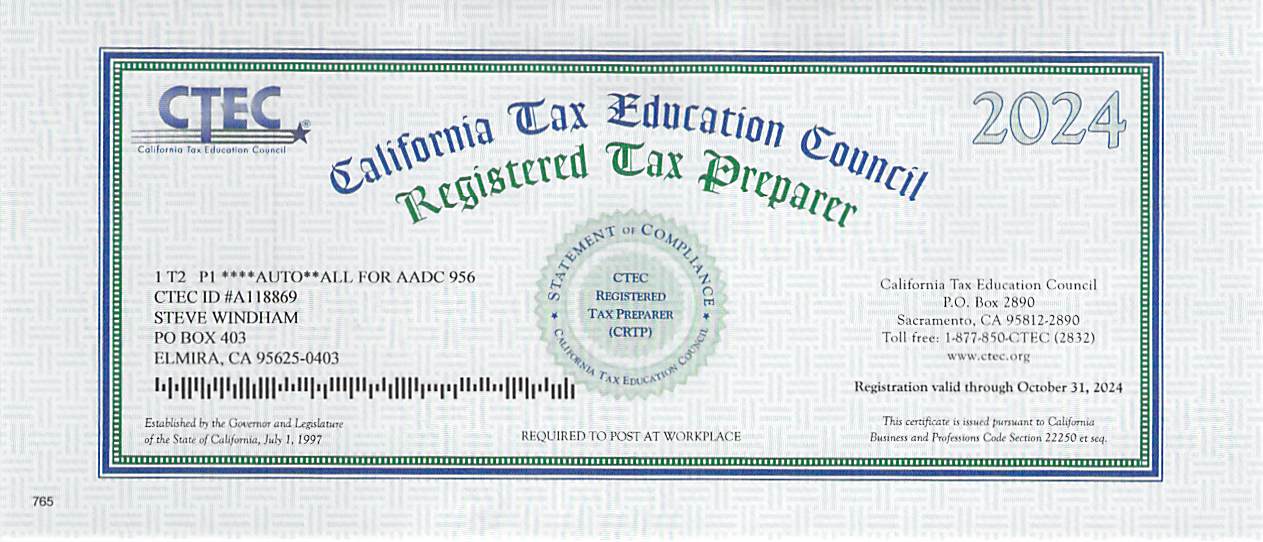

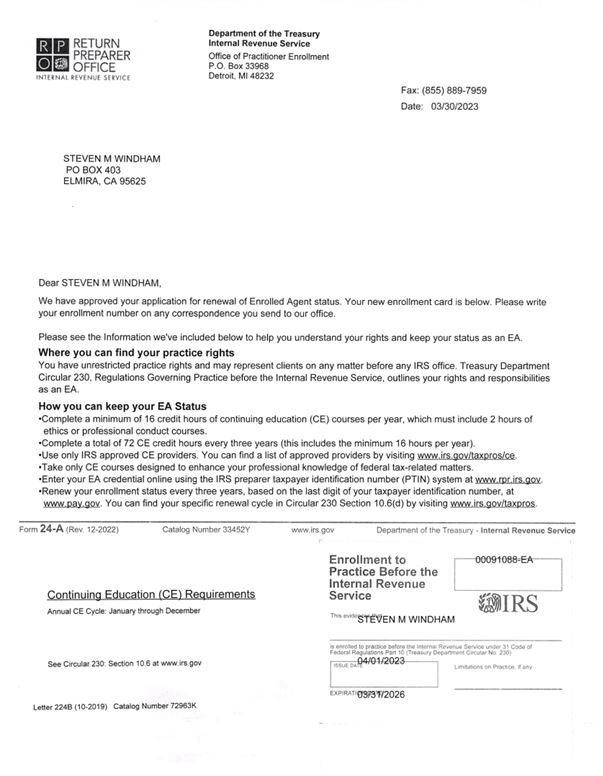

Mr. Windham has been a CTEC Registered Tax Preparer since 2003, and an IRS/US Treasury Enrolled Agent since 2008. Mr. Windham's favorite accounting/taxation activities are tax audits and teaching accounting.

In addition to working in accounting, Mr. Windham is a California credentialed educator with credentials in Adult Education and Career Technical Education, and has taught at various adult schools, Heald College, the University of Idaho, and various accounting and photography courses offered through Windham Solutions.

In his spare time, Mr. Windham enjoys bicycling, kayaking, reading, hiking & walking, fishing, letterboxing, cooking, photography (including drone-based photography), spending time with his family, friends, & pets, and skateboarding.

Please visit: https://www.stevewindham.com to learn more about Steve M. Windham.

Alan Frazier

Outside Consultant and Bookkeeper

Email: alan@windhamsolutions.com

Mr. Frazier is a Vietnam-era veteran of the United States Navy. After leaving the United States Navy, Mr. Frazier worked for the Naval Reserves, the Defense Contract Administration, Long Beach Naval Shipyard, Aberdeen Proving Grounds, the Presidio, and Mare Island Naval Shipyard . He then became an information systems specialist with the Alameda County Probation Department, from which he retired.

After his retirement, Mr. Frazier pursued his interest in accounting, studying at the Fairfield-Suisun Adult School, where he met Steve Windham. His first accounting job was a Tax Associate at H&R Block, eventually becoming a Senior Tax Specialist.

Mr. Frazier presently is a Registered Tax Preparer with the California Education Tax Council (A308266), and he is also licensed to transact California Accident, Health, and Life Insurance (License: 4059263).

Gurpreet Kaur

Associate

Email: gkaur@windhamsolutions.com

Ms. Kaur is an experienced CTEC Registered Tax Preparer, having worked at H&R Block for eight years. At H&R Block, Ms. Kaur started as a tax preparer, eventually working her way into management and training. Prior to H&R Block, Ms. Kaur worked as a staff accountant in a law firm, as well as in the construction industry.

Ms. Kaur is also a Registered Interpreter with the State of California in Hindi, and she is provisionally qualified in Punjabi and Urdu.

Ms. Kaur enjoys painting, reading, and playing puzzle games, as her hobbies.

Jeremy L. Strope

Associate

Email: jeremy@windhamsolutions.com

Mr. Strope is a California Tax Education Council Registered Tax Preparer (A345485). While he works with tax preparation on all levels, his focus is on international tax issues. He is presently working on obtaining several tax credentials from the Internal Revenue Service. In addition to tax preparation, Mr. Strope provides valuable support and IT services to Windham Solutions.

Prior to joining Windham Solutions, Mr. Strope worked in logistics. Mr. Strope is also a veteran, having served as a submariner in the United States Navy.

In his spare time, Jeremy enjoys gaming (board games and video games), reading, and cooking.

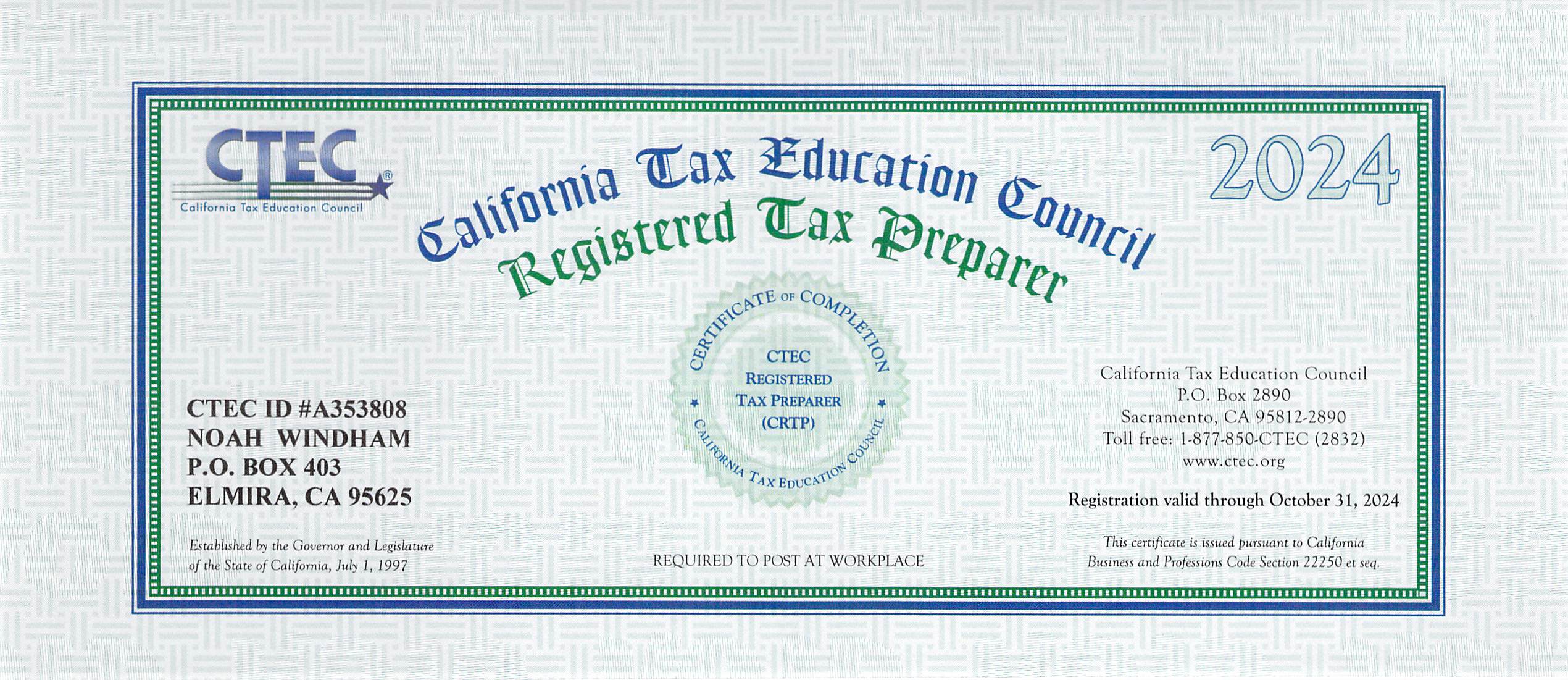

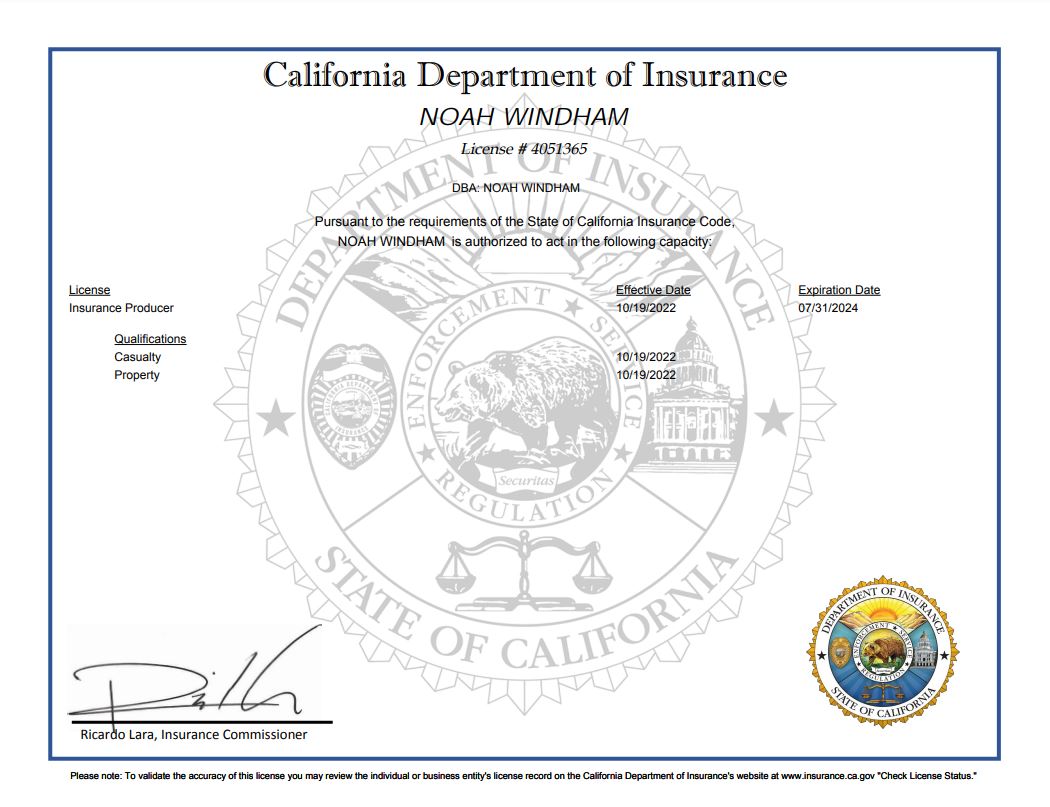

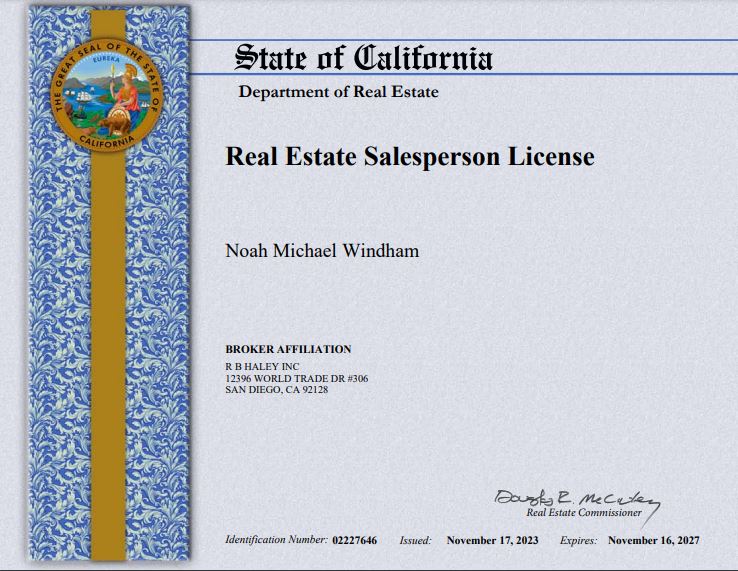

Noah M. Windham

Outside Business Associate

Email: noah@windhamsolutions.com

Mr. Windham is a licensed California Property & Casualty Insurance Agent (License Number: 4051365) with extensive experience in contractor's and workers' compensation insurance.

Noah also is a licensed California Real Estate Sales Agent (License Number: 02227646).

Please visit: http://www.noahwindham.com/ to learn more about Noah M. Windham.

US Global Tax, Ltd.

Former Business Associate

After more than a decade of working with US Global Tax, Ltd., we have parted ways.

If I did work for you whilst at US Global Tax, Ltd., it was as an independent contractor, and you should contact them directly if you have any questions about the work performed or if you need copies of records, tax returns, et cetera.

If needed, IRS Transcripts may be obtained directly from the IRS. Transcripts from other tax agencies can generally also be obtained directly from those agencies. If you deal directly with the tax agency(ies), there should not be any fees associated with obtaining copies of your transcripts and/or tax records.

Secretaries of State often charge fees for copies of records.

Third-party agencies, such as those used for incorporating and other similarly situated filings, often charge fees for copies of records.

You may be looking for other individuals associated with Windham Solutions. Please see below for links to their respective pages.

You can also visit us and rate us at the following places: